3 minute read

written by:

PropertyBoss Apr 2015 0 CommentsScreening for Better Tenants

Most lease-ups result in entrusting a rental unit to a total stranger. The only method we have to mitigate this risk is to try to check the background of the prospect using the best tools and technology we can. This background check can include credit, criminal, and personal references. This process can lead to three results: the applicant is approved as-is, approved conditionally (where they may be required to increase their deposit or provide a cosigner), or rejected.

THE APPLICATION PRoCESS

A prospective tenant completes an application, pays an application fee and, depending on your criteria, pays a deposit to hold the property.Your rental application collects the personal information of the applicant that you will need to screen the prospective tenant. This information includes their social security number, date of birth, address, employment, and criminal/eviction history. The applicant’s signature attests to the accuracy of the provided information, their agreement to any terms and conditions, as well as their consent and acknowledgement to obtain a screening report. Be sure to comply with the Federal Trade Commission’s (FTC) identity theft Red Flags Rule since you are collecting personal information.

THE SCREENING PRoCESS

Before you screen any applicants, you must first determine what selection/approval criteria you will use when screening applicants. It is absolutely essential that you apply this criteria routinely and fairly to prevent any potential charges of unfairness. The best approach is to let your credit reporting agency utilize technology to automatically apply your criteria to their reports and give you an automated yes/no/maybe decision. This approach limits any liability you have for decisions made and also prevents rogue employees from approving/rejecting applicants for personal reasons. There should also be a mechanism in place by your provider to seamlessly change these factors based on any criteria you would update, such as lowering or raising credit scores based on occupancy.

wHAT IS A CREDIT REPoRTING AGENCy?

A Credit Reporting Agency (CRA) can save you time and money by doing the legwork, as well as making sure you are in compliance with policies defined and regulated by the Fair Credit Reporting Act (FCRA). There are three different types of Tenant Screening services.

Traditional Tenant Screening

A CRA has its own application process you have to follow to be able to pull credit reports. This process, including a site visit to your office, must be completed before reports can be requested. To comply with reporting requirements, the CRA must verify your identity and your business purpose. If you have a smaller business and work out of your residence, you may not qualify for many of the CRA programs. Inquire about this requirement upfront if you have reason to believe you will not pass the underwriting requirements. Some CRAs have special programs to address these situations.The credit report will also be provided to the prospective tenant upon their request. These agencies can provide you with a depth of information while also complying with the Fair Housing guidelines and removing the subjectivity in the process.

Applicant Initiated Screening (Direct to Consumer)

The prospective tenant orders the report before providing it to you and other prospective landlords. You need to know of, and trust the CRA, so you can ensure that accurate information is provided and has not been altered.

Tenant “Report Cards”

These are fairly new to the world of tenant screening. Essentially, these services collect references online from property owners and managers and share them with other owners/managers. Although they are compliant with the Fair Housing Act, Privacy Laws and the Fair Credit Act, your information is only as reliable as the source. You may be able to glean more

information if an eviction did not reach the courts and therefore does not have a case associated with it, but caution should be executed as these may be subjective views by previous landlords rather than indisputable facts.

wHAT wILL My SCREENING REPoRT INCLUDE?

The tenant screening process may include some or all of the following:

- Credit Score -Credit score, defaults, late payments and judgments against that individual (or individuals) is obtained from one of the three national credit bureaus (Equifax, TransUnion or Experian).

- Criminal Records -Many property owners consider this one of the most important reports; this data is more difficult to obtain from the many different agencies and can contain false positives. You should carefully examine this report for mistakes.

- Sex Offender Registry -If a prospective tenant is a registered sex offender, you many want to reject their application to negate the liability you may encounter.

- Tenant Scorecard – Grades a tenant from A to F based upon their previous performance as a renter(cited for property damage, eviction, or missed rent payments).

- Eviction Records – Shows filings in addition to judgments; you can see that someone was in the process of being evicted, but then paid their rent and the eviction was dropped.

- OFAC Search – Identifies individuals (through the Office of Foreign Asset Control) with U.S. Department of Treasury economic or trade sanctions.

- Employment Verification -A call is made to the stated employer to confirm that the applicant has a steady income level to cover the rent.

wHAT ARE My RESPoNSIBILITIES?

The primary governing body for consumer reporting is the Fair and Accurate Credit Transactions Act(FACTA). States also have passed their own laws regulating consumer reporting, although Federal law does pre-empt state law in the instance of any inconsistencies. The regulatory authority of these laws is the Consumer Financial Protection Bureau.

These laws affect consumer reporting and the screening process in many ways. In a nutshell, they are in place to protect individuals from being treated differently regardless of race, ethnicity or other protected classes. They also protect the consumer’s personal information by providing regulations of how the information may be used and how it must be protected. These laws also often limit what landlords may charge for the screening process, typically not to exceed the costs associated with acquiring the information.

LEGAL AND LEGISLATIVE TRENDS

Advocates for fair housing are beginning to incorporate the ‘doctrine of disparate impact’ to bring discrimination claims against landlords. The doctrine states that practices may be discriminatory and illegal if the “adverse impact” they have upon a minority group is disproportionate to the whole.

An argument is that those of certain races and ethnicities are disproportionately represented within the criminal justice system, thereby making the use of criminal records within the tenant screening process disparaging among those groups.

Landlords and property owners are countering with the argument of their right to protect their properties and the communities within them from those committing serious crimes against person or property.

They are also limiting their liability to claims by using criminal records holding convictions versus arrests and specific offenses that are directly relevant to tenancy.This argument and potential future legislation are ongoing and it will be interesting to see where it leads over the next few years.

SELECTING A CRA

A few items to consider in choosing a CRA:

- Industry Experience – Number of years in business

- Integration Partners – Seamless access to reports directly through their property management software

- Industry Affiliation – Active in the industry, not just providing reports. Does the CRA provide rental specific information?

- Customization – options for multiple properties, multiple locations, and customized reports

- Data Integrity – Make sure you are getting the best information for where you are located and what meets your selection criteria

- Easy to read reports – Not all reports are easily displayed with a decision evident; ask for a sample

- Timeliness of delivery – Instant reports should be just that (4-6 seconds); another benefit from a direct interface

- Value – Get the report that meets your criteria for move in at a good price, not the least expensive reports that may

create holes in your selection process

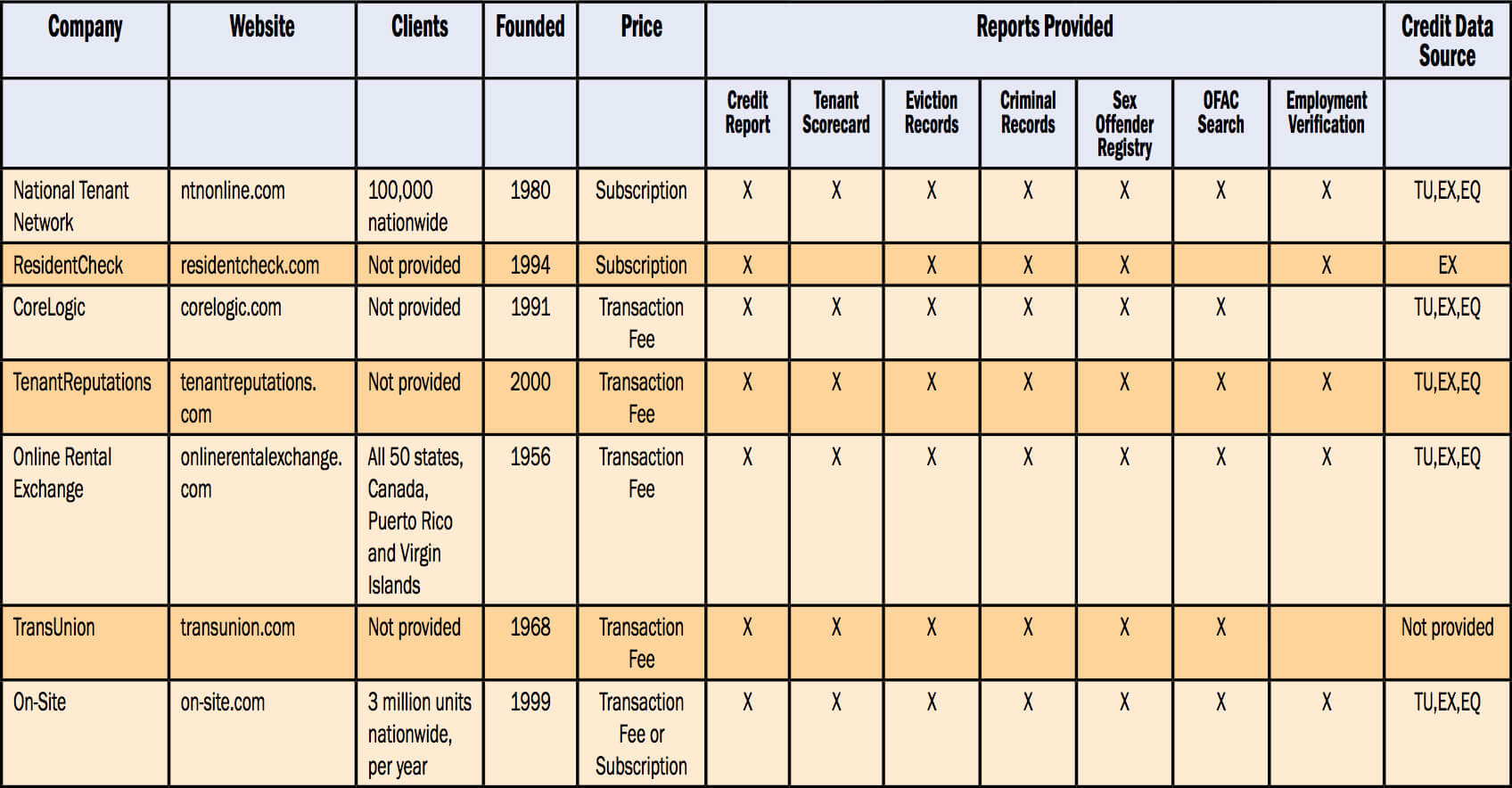

To assist in this process we have constructed the table below. The list was compiled by polling property managers and exhibitors at NARPM® conferences. A more comprehensive list is available online at propertyboss.com/narpm or by using the QR code on page 13. Please identify any CRAs that you would like added to the list.

- Other Topics:

-

Unlocking Efficiency and Sustainability with PropertyBoss Utility Billing

Are you exhausted from grappling with the complexities of utility management, unclear billing processes, and subpar customer service? It’s time to upgrade your property management game with the all-new PropertyBoss Utility Billing—a comprehensive platform designed to revolutionize your processes, maximize revenue, and foster sustainability within your community. And the best part? It’s all within the … Continue reading Unlocking Efficiency and Sustainability with PropertyBoss Utility Billing

...read more -

5 Tips to Help You Survive a Property Management Tax Audit

The chances of your business every coming under the scrutiny of the IRS for a tax audit are pretty slim, but it does happen. In case it happens to your property management business, you want to make sure you’re prepared. To help, we’ve put together some tips to assist you, just in case you ever … Continue reading 5 Tips to Help You Survive a Property Management Tax Audit

...read more -

The Power of Renters Insurance

As a property manager, you know how important it is for your new and existing tenants to get renters insurance, but the issue is that you need to find a way to communicate that with them. While you do your best to make sure your properties are always updated and up to code, that doesn’t … Continue reading The Power of Renters Insurance

...read more