3 minute read

written by:

PropertyBoss May 2015 0 CommentsMaking Your Accounting Add Up

You can make your business stronger and more agile by transforming your typically “back-office accounting” into a “front-office tool” for intelligent business decisions. Regardless of whether you use an integrated accounting system or an interfaced accounting system, you should be able to improve the tracking and collection of rent and payments to vendors, owners and other parties.

INTeGRaTeD Vs. INTeRfaCeD

What is the difference between an integrated accounting system and an interfaced accounting

system?

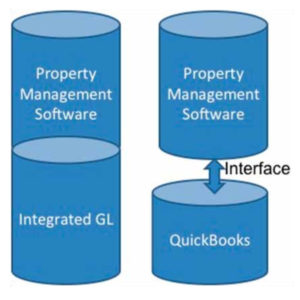

An integrated accounting system is an integral part of your property management enterprise software. The accounting component includes the features most often used within the business processes of property management.

An interfaced accounting system refers to an independent product separate from your enterprise software solution. Popular choices include QuickBooks, Sage 50 (formerly Peachtree), Microsoft Dynamics, etc. They are sometimes referred to as “best of breed” solutions because they are focused solely on providing the best accounting functionality. They are “interfaced” because there are multiple points of interaction between the two different systems.

INTeGRaTeD aCCOuNTING sysTeM

Pros

One of the most common reasons businesses choose to use an integrated system is that it is fast and easy. You only have to make one decision about which software to use and there are fewer steps to install, train, and implement the software.

Typically, an internal system is less likely to have issues with integrating between the property management functionality, and the accounting functionality since the two systems are developed by the same programmers; and the accounting does not depend on the property management system exchanging data.

Integrated systems are designed specifically for property managers and will have the ability to offer features that reflect the business process available within the primary property management software solution.

Common accounting transactions include rent collection, vendor & owner payments, and many times it will have the ability to integrate with your financial institution as well.

Downfalls

With all that integrated systems offer, they do have a few drawbacks as well. Integrated systems, because they focus just on the property management solution, do not have the sophistication, accounting rigor, and reporting flexibility that can be found within a dedicated commercial accounting package.

Commercial accounting systems have capabilities including payroll, taxes, depreciation schedules, currency conversions, partnership interests, etc. that are typically much more advanced than are found in most integrated systems. Also, if your company has activities other than Property Management, integrated systems rarely offer the level of capabilities you need to handle divisional accounting.

Accounting/Tax firms are also very familiar with commercial accounting packages and can quickly derive the necessary tax information from an accountant’s copy of the software or specialized reports for the accountant. A common refrain from your tax accountant is to “just send your QuickBooks file to me.” They have a software copy (often a specialized version) of

the popular accounting software packages enabling them to review the file directly. This lack of extensive experience with the integrated accounting system may require much more research and preparation time for you and your accountant.

INTeRfaCeD aCCOuNTING sysTeM

Pros

Moving forward with an interfaced accounting system provides you with a solution that is an industry standard. Within the accounting community the integrated system you choose is likely to be well known and understood by accountants.

Industry standard packages will also provide a wider array of reporting and functionality as it applies to various ownership structures and classes. They also tend to offer the capability of handling payroll, tracking timesheets and many times can even track, process and manage shipments within your organization.

The additional functionality available by an integrated system also applies to your company as a whole, as it can consolidate finances of several divisions, including your property management division.

Downfalls

As wonderful as the wider array of functionality and universal standard seems to be, interfaced systems also have their share of pitfalls.

Running two systems requires people who understand both systems and understand how the interface sends information between the systems. It is the lack of understanding of how the interface works that often causes problems. For instance, if you want to delete/void a check, how do insure that both systems stay in sync? If the change is made in one system, will the change be reflected in both? If the systems do get out-of-sync, how do you go about finding and correcting the discrepancy.

CONsIDeRaTIONs

Now that you know the pros and cons of each option, you may be asking yourself how to choose the the accounting system that is right for your company? Here are some considerations:

- Company Size A smaller company dedicated solely to property management may not need all of the bells and whistles that a commercial accounting package provides. In practice, the additional functionality may prove to be more cumbersome that beneficial. In this situation, an integrated system may be more helpful.

Larger companies particularly those comprised of different divisions may find an integrated system to be a detriment to their needs for growth, accountability, reporting, and transparency within the organization.

Of course, smaller companies often become bigger or more complex companies over time. As your needs change, you may need to change from an integrated accounting system to an interfaced accounting system. Some software vendors provide a choice of options that may give you this ability to change.

- The Human Factor The employees who will be using the chosen software must be taken into consideration. Those without a financial background will find an integrated system easier to use, as there are fewer choices to make and generally a lower degree of training and knowledge that is needed.

The input of your accountant is also important as they may prefer a particular accounting system with which they are already familiar. Their input into your selection process can improve the speed (as well as the cost) of them being able to complete your accounting and tax statements.

- Impact of Growth When considering an accounting system, it is really important to ask yourself a few questions, including:

- What do I need to run my business today

- What will I need to run my business five years from today?

- What would I change about the way I run my business if my accounting system would support it?

- Does this accounting system make it easier to run my business?

Growth of your company must be a consideration from the beginning of the selection period as time, energy and effort must be invested when launching an accounting system. Make sure you are selecting a system you can use, not only today, but for several years to come.

IN CONCLusION

While every system has its limits, choosing the right system for your company now, as well as for the future, can save you time, money and headaches.The right accounting system can not only help you save on costs, but many of these services can help you spend more time growing your business rather than just accounting for it.

- Other Topics:

-

Unlocking Efficiency and Sustainability with PropertyBoss Utility Billing

Are you exhausted from grappling with the complexities of utility management, unclear billing processes, and subpar customer service? It’s time to upgrade your property management game with the all-new PropertyBoss Utility Billing—a comprehensive platform designed to revolutionize your processes, maximize revenue, and foster sustainability within your community. And the best part? It’s all within the … Continue reading Unlocking Efficiency and Sustainability with PropertyBoss Utility Billing

...read more -

5 Tips to Help You Survive a Property Management Tax Audit

The chances of your business every coming under the scrutiny of the IRS for a tax audit are pretty slim, but it does happen. In case it happens to your property management business, you want to make sure you’re prepared. To help, we’ve put together some tips to assist you, just in case you ever … Continue reading 5 Tips to Help You Survive a Property Management Tax Audit

...read more -

The Power of Renters Insurance

As a property manager, you know how important it is for your new and existing tenants to get renters insurance, but the issue is that you need to find a way to communicate that with them. While you do your best to make sure your properties are always updated and up to code, that doesn’t … Continue reading The Power of Renters Insurance

...read more